Calculate depreciation of house

Without Section 1250 strategic house-flippers could buy property quickly write off a portion of it and then sell it for a profit without giving the IRS their fair share. Suite 25 321 Pitt Street Sydney NSW 2000 Australia.

Depreciation Of Building Definition Examples How To Calculate

The house depreciation rate will depend mainly on the system you intend to use as there are two primary ways to calculate your own deprecation.

. 10 55 x. To figure out the depreciation on your rental property. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. However there are exceptions too which we will discuss later in this article. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The resulting number expressed as a percentage is your inventory holding cost. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years. You can then calculate the depreciation at any stage of your ownership.

There are 2 ways you can access the tool. Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. Note that the 275 and 39-year depreciation calculations are typically based on a mid-month convention.

The most accurate way to calculate the cost of depreciation for a fleet is by using the accelerated method. As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system. To calculate the impact of depreciation compare an example for a commercial truck worth 100000.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. If youre looking to calculate the depreciation of your assets on a monthly basis The Ascent walks you through 2 methods with examples. If you have a mortgage youll need to factor in your.

Unlike double declining depreciation sum-of-the-years depreciation does consider salvage value when calculating depreciation so your first year depreciation calculation would be. Therefore the land was valued at. Meaning in the first month you acquire the property you would get half mid-month of the first months depreciation not an entire month and the same holds true in the month you dispose of the asset.

If you depreciate your asset using the General Depreciation System which lasts 275 years you would depreciate an equal amount. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered. An old construction is not as attractive as a new one and therefore its value dips.

Have complex depreciation claims for example intangible depreciating assets including in-house software an item of intellectual property except a copyright in a film or a telecommunications site access right. To calculate the percentage ROI for a cash purchase take the net profit or net gain on the investment and divide it by the original cost. How to calculate depreciation of property.

How to Calculate Real Estate Depreciation. Use this House Deposit Calculator calculate the deposit amount and find out how much you need to save a month or how long to save for. Add these amounts together and divide that number by the total value of your annual inventory.

Use a House Depreciation Calculator. Get 247 customer support help when you place a homework help service order with us. Section 179 deduction dollar limits.

Land is valued at market prices even in the case of an independent house and it is the structure that decreases in value. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own.

To calculate your inventory holding costs first determine your storage employee wages inventory depreciation and opportunity costs. If you acquire ownership of a home as. So in our example Marks property was last assessed at 120000 and the assessor valued the house at 90000 75 of value.

3636 each year as long as you continue to depreciate the property. It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties. For example the Washington Brown calculator features each of the alternatives mentioned here in one place.

Calculate My Estimated Depreciation. The useful age. Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are married and file a joint return.

Allocate that cost to the different types of property included in your rental such as land buildings so on. The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019. Section 1250 helps protect against this kind of tax avoidance.

Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. Another option is to use a house depreciation calculator. How to Calculate Depreciation Three factors determine the amount of depreciation you can deduct each year.

So if you use an accelerated depreciation method then sell the property at a profit the IRS makes an. Get a great deal on a great car and all the information you need to make a smart purchase. Using your myGov account.

This process informs investors on how much they can depreciate each year. Depreciation is a tax deduction available to property investors. For instance if a buyer is selling a property after 10 years of construction the selling price of the structure can be calculated.

For an independent house the average lifespan of any building is 60 years. Find new and used cars for sale on Microsoft Start Autos. Your basis in the property the recovery period and the depreciation method used.

Get 247 customer support help when you place a homework help service order with us. Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. The IRS has a defined process for calculating depreciation.

The following article will explain the. Without a myGov account. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

If your profit exceeds the 250000 or 500000 limit the excess is typically reported as a capital gain on Schedule D. Determine your cost or other tax basis for the property.

Appreciation Depreciation Calculator Salecalc Com

Accumulated Depreciation Explained Bench Accounting

Straight Line Depreciation Calculator And Definition Retipster

How To Calculate Depreciation On A Rental Property

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

How To Calculate Property Depreciation

How To Use Rental Property Depreciation To Your Advantage

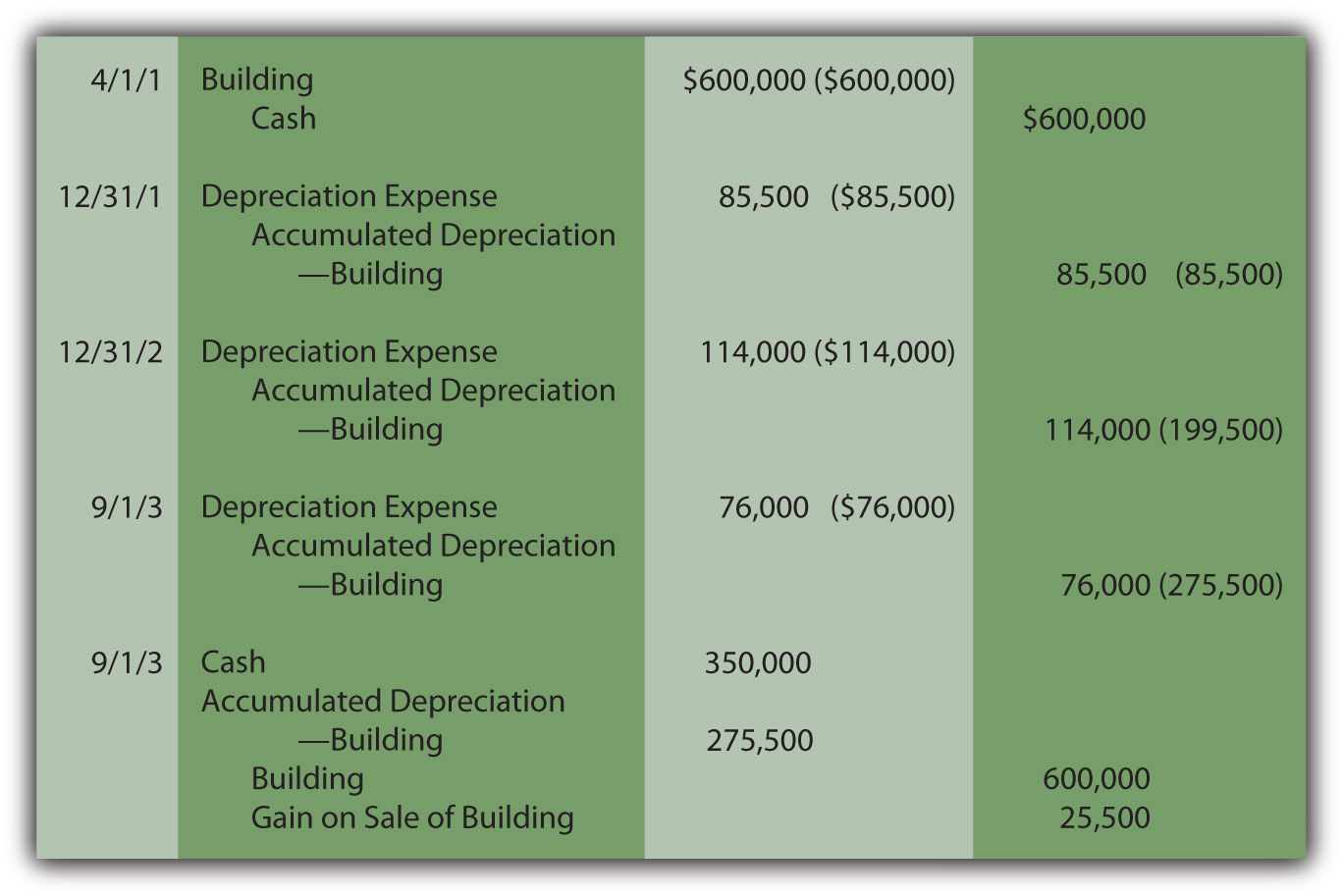

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Calculate Depreciation Expense For Business

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Appliance Depreciation Calculator

Straight Line Depreciation Calculator And Definition Retipster